Have you already registered with the property tax portal? Skip the instructions and go directly to Property Tax Portal

With this self-serve property tax tool, Oakville property owners can:

- View their property tax information, account balance and payment history

- Sign up for, change or cancel a pre-authorized payment plan(s)

- Print a statement of account or bill (2025 onward)

- Sign up for electronic billing (e-billing) for property tax

- Submit a request to change your mailing address or contact information

What you should know before you sign up

- Registering for the online property tax portal is optional.

- Registering does not automatically sign you up for e-billing. You will have the option to change your delivery method within the portal.

- When signing up for e-billing, you will receive an email notification when your tax bill is ready to be viewed online. A copy of your bill will not be emailed to you.

- Requests to change a mailing address or pre-authorization payment plan (PAP) will take up to five business days to process. You will be notified by email when the request is completed.

- Access codes are only available to persons on property title (ownership).

- Access codes are owner unique; a new one will be created upon a change in property ownership.

- You will only have the ability to see your tax information based on your property ownership timeframe.

Sign up for the property tax portal

Steps to register or log in to the property tax portal:

- Register for/sign in to the town's Online Services

- Click the "Property Records and Tax" button and then select the “Access the property tax portal” button

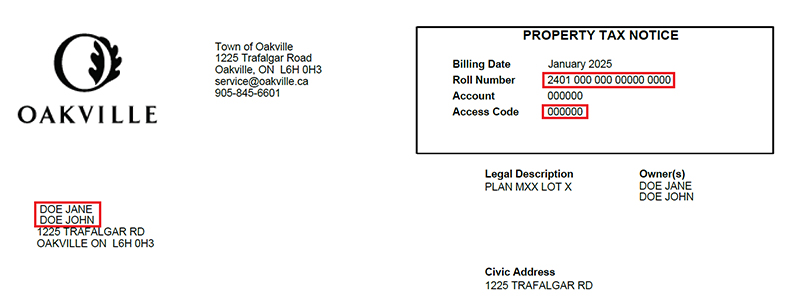

- Enter your property information as it appears on your property tax bill starting in 2025

Your property roll number found on your tax bill (not including spaces or dashes)

Your property access code (which can be found on your tax bill)

The ownership name on account as it appears on your tax bill (last name, first name, middle name) must be entered in all capital letters

Type your name exactly as it appears on your tax bill. This includes spaces and your middle name if it is printed on the tax bill. Please note your middle name may not have been printed on the letter you received with your access code.

If multiple owners are listed on the tax bill, only one person's name is required to set up the account

Once you have successfully registered with the Property Tax Portal, access your information anytime through Oakville’s Online Services.

If you have any questions or concerns, please contact service@oakville.ca

Sign in to Online Services

Questions or concerns?

For any questions or issues or troubleshooting with the Property Tax Portal, please contact service@oakville.ca